Finance Minister Nirmala Sitharaman presented the Union Budget 2025-26, focusing on tax relief for the middle class, agricultural reforms, and initiatives to boost India’s economic growth. The budget aims to reduce the fiscal deficit to 4.4% of GDP in FY26 while prioritizing inclusive development and private sector investments.

Key Highlights

Tax Reforms

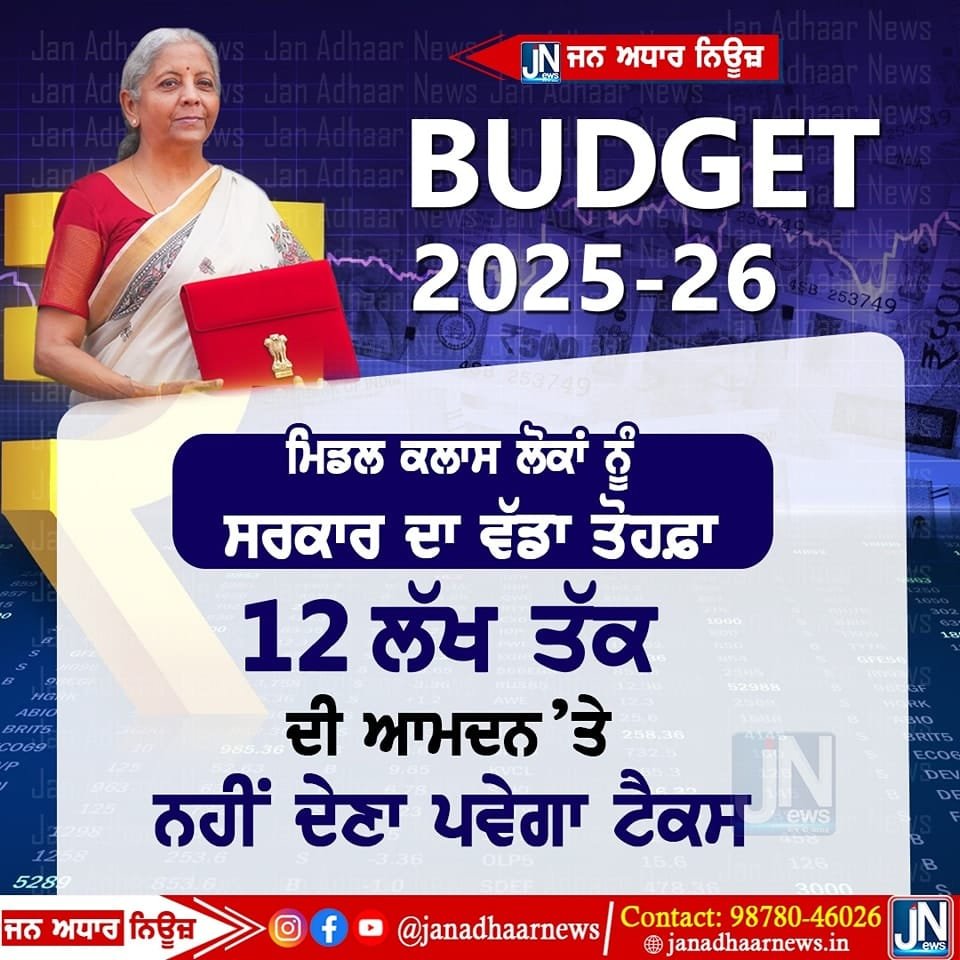

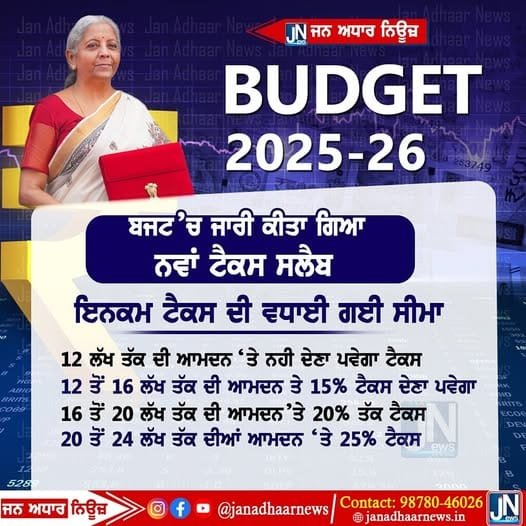

- No income tax for individuals earning up to ₹12 lakh annually under the new regime, benefiting over 1 crore taxpayers.

- Standard deduction increased to ₹75,000 for salaried individuals, extending tax exemption to ₹12.75 lakh annually.

- TDS limits on rent raised from ₹2.4 lakh to ₹6 lakh, easing compliance for small taxpayers.

Sectoral Focus

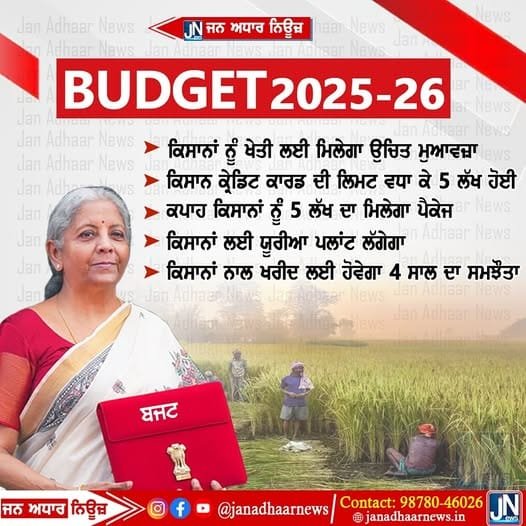

- Agriculture: Launch of PM Dhan-Dhaanya Krishi Yojana to boost productivity in 100 low-yield districts and a 6-year mission for self-reliance in pulses.

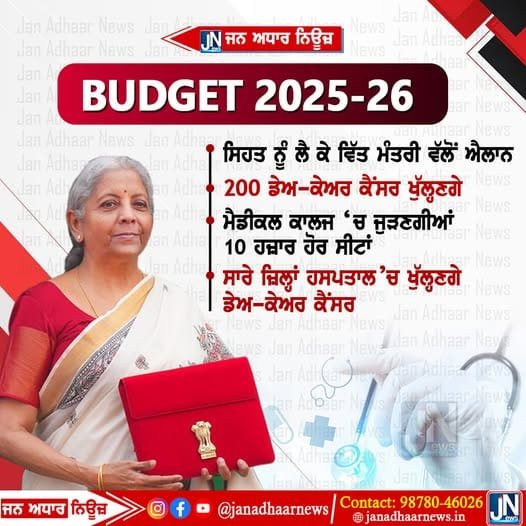

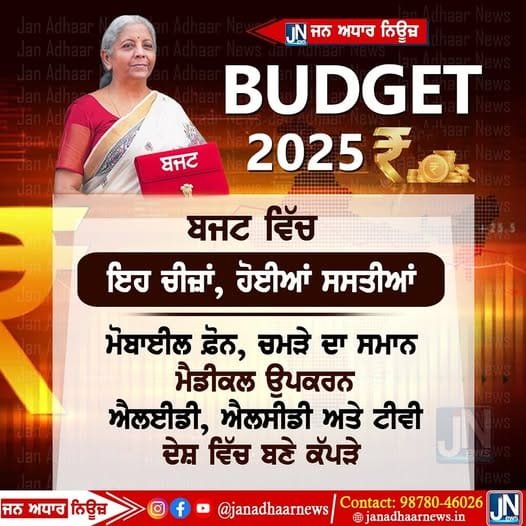

- Healthcare: Full customs duty exemption on 36 life-saving drugs and plans for 200 cancer care centers in district hospitals.

- MSMEs: Credit guarantee cover doubled to ₹10 crore and customized credit cards for micro-enterprises introduced.

Economic Growth & Employment

- FDI limit in insurance raised to 100% to attract global investments.

- Five National Centres of Excellence for Skilling to prepare youth for manufacturing sectors, targeting “Make for India, Make for the World”.

- Initiatives to generate 22 lakh jobs in footwear, leather, and toy industries through sector-specific schemes.

Fiscal Targets

- Revised fiscal deficit for FY25 at 4.8%, with a FY26 target of 4.4%.

- Total expenditure estimated at ₹50.65 lakh crore for FY26, emphasizing infrastructure and rural development.

The budget aligns with the government’s vision of Viksit Bharat (Developed India), targeting zero poverty, universal education, and 70% women’s workforce participation by 2047